Google has shared some details of its web3 and blockchain strategies. “As a company, we are looking at how we might contribute to the ecosystem and add value,” said Sundar Pichai, the CEO of Google and its parent company, Alphabet Inc.

Google’s Web3 and Blockchain Strategies

The CEO of Alphabet Inc. and its subsidiary Google, Sundar Pichai, shared some information on the group’s blockchain strategy during the company’s Q4 earnings call last week.

Pichai was asked about his view on web3 and Alphabet’s approach to the industry. “Anytime there is innovation, I find it exciting,” the Google CEO began, elaborating:

On web3, we are definitely looking at blockchain, and such an interesting and powerful technology with broad applications, so much broader, again, than any one application.

“As a company, we are looking at how we might contribute to the ecosystem and add value,” he continued, adding:

Just one example, our Cloud team is looking at how they can support our customers’ needs in building, transacting, storing value, and deploying their products on blockchain-based platforms.

“So we’ll definitely be watching the space closely and supporting it where we can. Overall, I think technology will continue to evolve and innovate and we want to be pro-innovation and approach it that way,” the CEO opined.

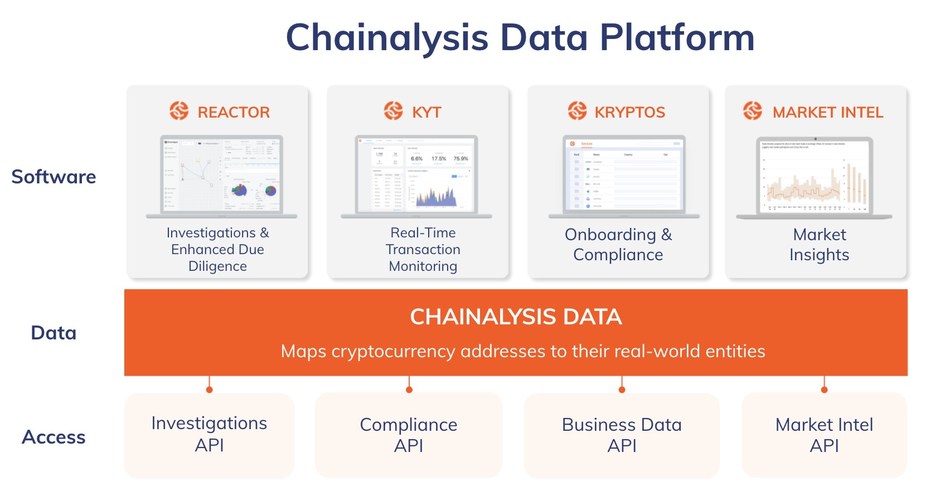

Google’s Cloud division recently formed a group to build business around blockchain applications. Richard Widmann, head of strategy for digital assets at Google’s Cloud unit, said the group plans to hire a slew of people with blockchain expertise. “We think that if we do our jobs right, it will drive decentralization,” he was quoted by the media as saying.

The executive added that Google is currently considering what types of services it can offer directly to developers in the blockchain space. Thomas Kurian, Google’s cloud CEO, has identified a number of areas, including retail and health care.

Shivakumar Venkataraman, an engineering vice president for Google, is now running a unit focused on “blockchain and other next-gen distributed computing and data storage technologies,” Bloomberg reported last week.

What do you think about Google’s web3 and blockchain strategies? Let us know in the comments section below.

#AsiaNews #Banking #Bitcoin

#Blockchain #Brexit #Coronavirus

#CryptocurrencyPrediction

#Digital Currency #Forex

#GlobalEconomy #Gold #Legal

#Luno #PiNetwork #StockMarket #StormGain

#WorldNews #HoubiGlobal #RoyalQ #USDT #CryptoExchange