It is easy enough to determine some prominent cryptocurrencies surviving, if and when 8a crash does occur

Price volatility is a huge concern in the cryptocurrency market. There’s some degree of volatility involved with the stock market too, but the cryptocurrency market, being fairly new, comes with lesser understanding. Out of all the understanding that experts have, a recent trend was noticed by analysts – cryptocurrency crashes that usually occur on weekends. Stephen McKeon, a finance professor and partner at Collab+Currency, a crypto focussed investment fund explained in an interview that liquidy requires study of the supply of buyers and sellers. If there are few buyers compared to sellers or vice versa, transactions that fluctuate will result in a spike or crash. A good place to start is the top 20 most-traded cryptocurrencies. It is easy enough to determine some prominent survivors in this listing, if and when a crash does occur in cryptocurrency markets.

Bitcoin

Bitcoin price has slumped to US$43,030 from the high of over US$47,700 on the 1st of January 2021. The falling cryptocurrency prices have dampened the celebration mood of retail crypto investors. But the downward price movement in crypto markets is nothing new, hence not surprising for hardcore crypto enthusiasts. Bitcoin is the original cryptocurrency and is fast emerging as a store of value. Its blockchain and codebase also spawned offshoots, such as Litecoin and Bitcoin Cash. Both are angling to become the preferred cryptocurrency for daily transactions.

Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization saw a substantial drop as well. The Ethereum-based cryptocurrency witnessed a plunge of 8.3% over the past 24 hours after a healthy start to the year. However, Ethereum’s world of decentralized applications or Dapps is fast gaining traction and is responsible for a slew of tokens such as Populous, which are built off its platform.

XRP

XRP is an open-source cryptocurrency that uses an open-source distributed ledger called the XRP ledger. It is the native coin of Ripple, which is an enterprise blockchain company that facilitates global transactions. The creators claim that XRP was built for payments and can settle transactions faster than most other cryptocurrencies securely and efficiently.

Cardano

Cardano is a research-based cryptocurrency built by engineers, mathematicians, and cryptography experts. It is open-sourced and decentralized, with consensus achieved using proof-of-stake. It can also facilitate peer-to-peer transactions with the ADA token. Cardano is one of the cryptocurrencies that are recovering from a crash in 2022.

Polygon

This platform looks to address many of the issues facing the Ethereum blockchain while still providing Defi solutions. Namely, the platform looks to create “Ethereum’s internet of blockchains” by connecting Ethereum-compatible blockchain networks and aggregating scalable solutions on Ethereum. It is also one of the cryptocurrencies that are recovering from a crash.

Litecoin

As one of the first digital currencies, Litecoin is increasingly getting adopted for real-world use, making it one of the fastest-growing digital currencies. The team has continuously been improving the network to increase speed, reduce cost and increase safety, making Litecoin one of the most attractive payment platforms. The latest update is about the increasing acceptance of Litecoin in the real world. More organizations are adopting LTC, with the recent being NetCent, Bitpay, and Verifone. Now Litecoin holders can buy goods and services from these stores. Litecoin Gaming is another recent development the team updated the community about. More is coming from the team.

Chainlink

Chainlink was designed with the motive of making smart contracts more useful. It is a decentralized network of oracles, which are capable of bringing real-world data into any blockchain network. Chainlink is the largest and most popular oracle network. Owing to its capability of integrating real-world data, the demand for Chainlink oracles will grow in the future.

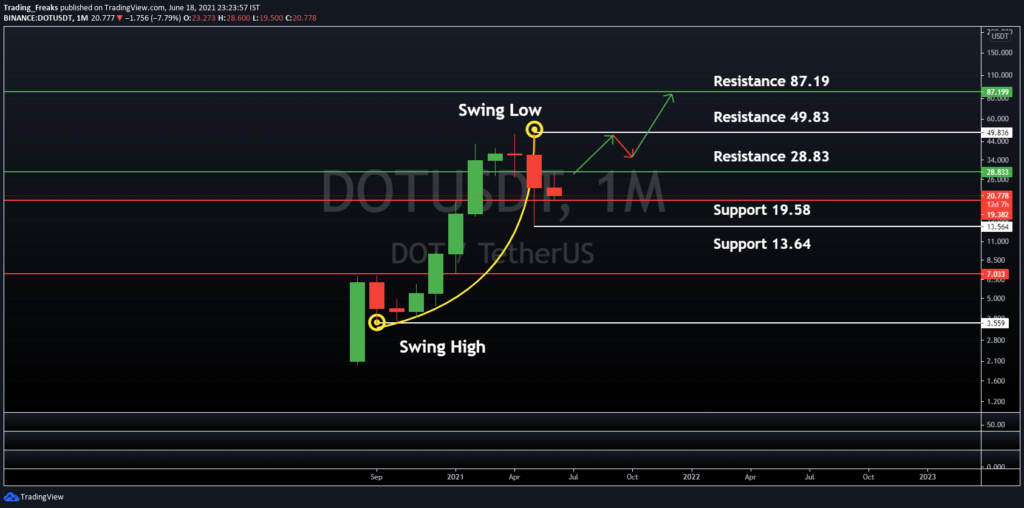

Polkadot

Polkadot was created based on research identifying the hurdles that blockchain networks will face in the future as crypto is becoming more mainstream and is promoting several innovations in the industry. One of the defining features that DOT possesses is functioning on a network that can connect other blockchain networks.

Dogecoin

The fact that Dogecoin still stands strong after not being taken seriously is a statement in itself. First, Redditors spiked the price to new heights in early 2021 as a way to prevent the speculated short-selling of Dogecoins by many Wall Street hedge funds. And then, Elon Musk called himself the “Dogefather” promoting this cryptocurrency further. While many argue the legitimacy of this coin, Dogecoin continues to have its share of market value.

Shiba Inu

Launched in August 2020, the rise of Shiba Inu in such a short time is nothing short of uncanny. At one point, Dogecoin stayed as the top meme currency without much competition. However, SHIB, another namecoin that was created out of online jokes that went viral in 2013 came to the play.