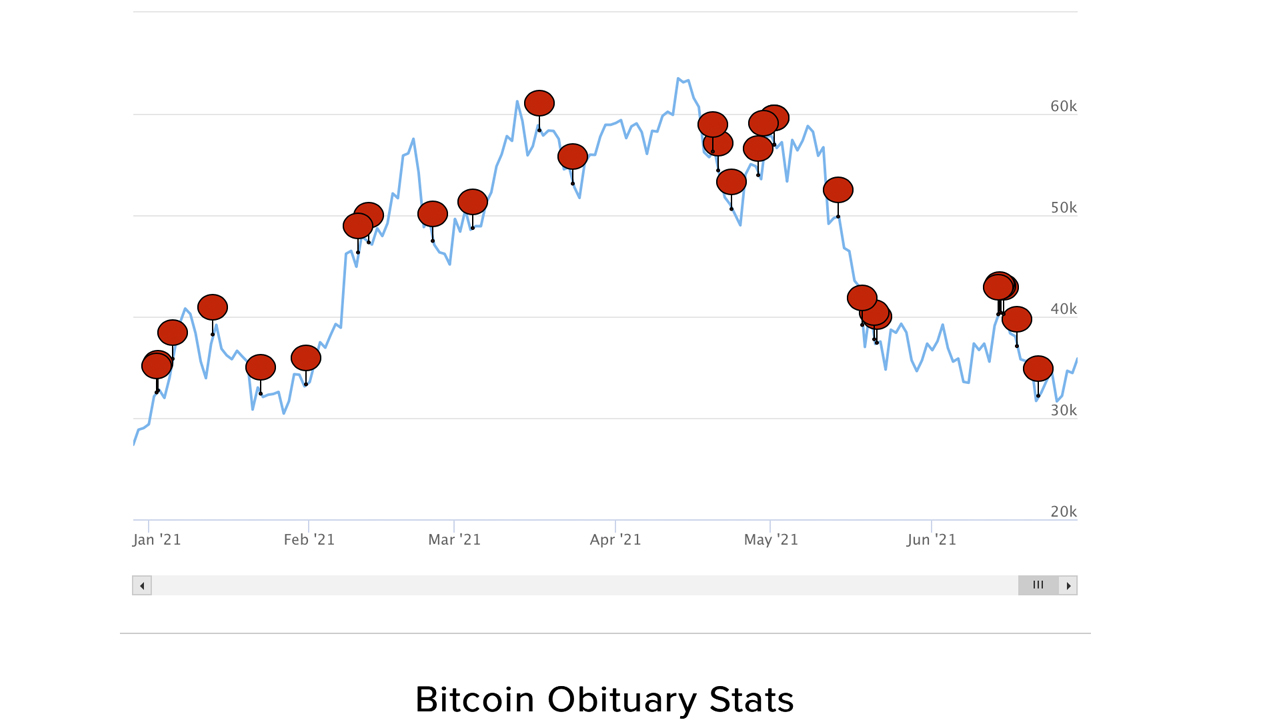

Cryptocurrencies remain extremely volatile. Bitcoin is consistently on track for topping their biggest monthly increase and decline. It faced one of their record-highs of 37.5% decline just this May 2021, and frequently sees drops like 37% drop seen in November 2018 and 40% slide in September 2011. Most recently, the price of bitcoin climbed to $34,805.19 Monday 28th June 2021, up 8% from where it stood at 5 p.m. ET Friday, after Mexican billionaire Ricardo Salinas Pliego encouraged its purchase. This volatility serves as a double-edged sword, both as an exciting asset choice for some investors and apprehension for others, preventing widespread adoption.

One contributing factor to volatility is that the crypto markets have an abundance of whales – a term given to someone who holds a significant amount of a particular asset; someone who holds a minimum of 1,000 Bitcoin is considered to be a whale. The sheer size of their holdings means that, when they decide to sell, the market is suddenly flooded with this asset, causing big price movements.

These powerful investors exist across all asset classes, but cryptocurrencies are particularly vulnerable because there are more whales, but much smaller volumes and less liquidity across a fragmented sea of exchanges. Without sufficient liquidity, these whales are trapped in a proverbial swimming pool, destined to send huge waves through the market as soon as they move. Because each exchange is segregated into their small swimming pools of liquidity, they are incredibly susceptible to whale movements.

For that reason, we need to solve the liquidity problem by joining all these segregated small swimming pools into one big ocean. The trading technology of the crypto market has not yet caught up to the maturity and stability of forex, which employs OTC trading, which is how it minimizes the effects of large buy and sell orders that can drastically move the market. If the crypto market integrates that, this can dramatically improve crypto exchange liquidity and stabilise pricing as a result. It’s time to deepen the liquidity pool.

The influence of whales

Cryptocurrency assets are still fundamentally very concentrated. The sudden growth of Bitcoin means that a large portion of the market is owned by a small majority of traders who were fortunate enough to buy lots of Bitcoin when the price was low. Currently, around 40% of Bitcoin is held in around 2,500 accounts.

The same is true of altcoins. For example, it was revealed in February this year that one person holds 28% of Dogecoin, which has soared by almost 1,400% since the start of the year. An individual in possession of that large a proportion of the market has a huge effect on the price.

And the effects of these whales are visible. When whales are selling, the prices of cryptocurrencies are on a downward spiral. On April 18th, for example, one trader moved 58,814 BTC – worth more than $3.3 billion at the time – from Binance to a private wallet at the same time as the prices slid to a low of $51,541 per unit.

While whales are clearly affecting the price of Bitcoin, their influence is greater among altcoins, which have lower market caps and are less liquid. Not long ago, the price of Ethereum plummeted by more than 50% on the Kraken Exchange, plunging from $1,628 to $700 within the space of minutes.

The CEO of Kraken attributed this to single sell, saying “it could be that a single whale just decided to dump his life savings.” For Ethereum to drop $1000 dollars in three minutes is extraordinary and it proves that even the biggest exchanges with large volumes can be rocked by big whale movements.

Shrinking liquidity

Considering price swings are compounded by fragmented liquidity, the market must pay attention to the fact that liquidity is getting worse, not better. The amount of Bitcoin on exchanges is down 20% over the last 12 months. Slowly but surely, liquidity is drying up and the pool is getting smaller.

The bullish cryptocurrency market means people are holding the asset, simply watching the price tick up. Evidence suggests that there is a growing number of whales, with the number of individual holders of over 1,000 Bitcoin at an all-time high of 2,334. So, despite growing popularity, there is still only a very limited amount and diminishing amount of cryptos changing hands.

Contributing to these problems, big investors are entering the crypto market in swathes. Institutional investors, hedge funds, high-net worth individuals, and companies – most famously Tesla – are all looking to hold and trade crypto assets. And with more buying power, it is likely to increase order sizes and add to the influence of whales.

We cannot prevent these big players from influencing crypto trading, but solutions for the underlying lack of liquidity that exacerbates price swings exists.

Unifying the pool

To combat whale-induced price swings, the market is slowly adopting tactics from other asset classes. For example, many OTC brokers are targeting crypto whales to trade digital currencies over the counter because they can access more liquidity than exchanges.

However, for a lasting solution that can cushion large orders and prevent sudden and drastic price changes, exchanges should turn to trading technology that has been mastered in other markets. For example, the FX markets have long provided Straight-Through-Processing capabilities on a global liquidity network, where orders are aggregated and processed using Smart Order Routing. This infrastructure allows global price discovery, where the best bid and ask prices are presented to all market participants, regardless of trading avenue.

Effectively, it allows exchanges to leverage the liquidity of other exchanges, including from the biggest in the industry. Using this model, exchanges can consistently provide traders the best prices and absorb the impact of big whale splashes by drawing on liquidity from the wider market. The multiple individual pools join to become an ocean.

Only once these issues are addressed will cryptocurrencies be free of the volatility that comes with so many big fish in a market lacking depth.