Bitcoin, the leading crypto asset in terms of market capitalization, has seen the cryptocurrency’s network hashrate drop considerably during the last two weeks. On Saturday, July 3, the network’s mining difficulty will see the largest epoch drop in history as the difficulty is set to slide by more than 27%.

Bitcoin Difficulty Expected to Drop More Than 27%

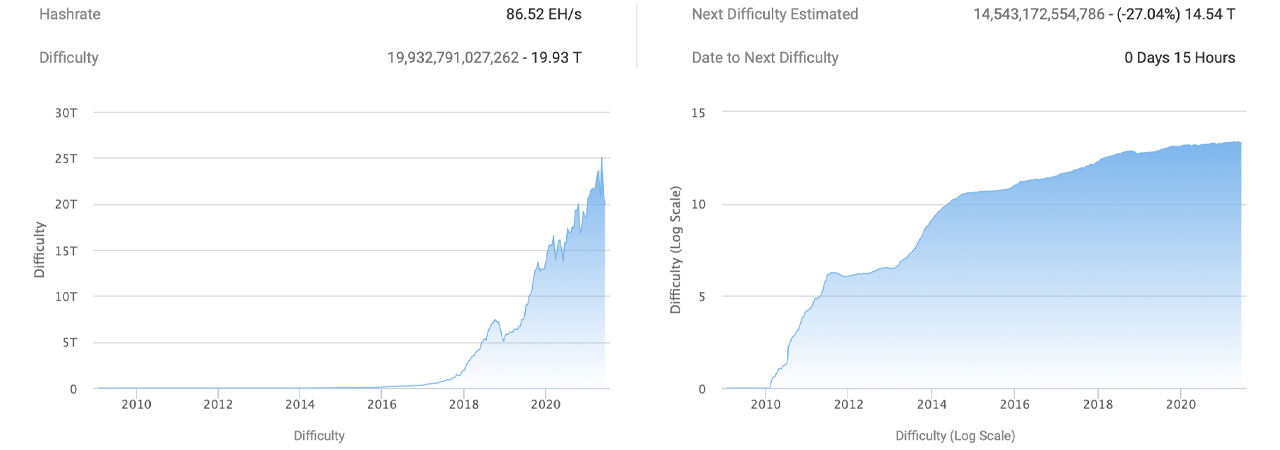

This weekend, Bitcoin (BTC) is set to experience the largest difficulty drop ever recorded during the crypto asset’s lifetime. At the time of writing, BTC’s mining difficulty is 19.93 trillion and is expected to drop 27.04% by Saturday morning (EDT). In bitcoin mining, the network’s difficulty is the parameter that keeps the average time between BTC blocks consistent.

The difficulty parameter is the metric that shows how difficult it is to mine a bitcoin block and the higher the difficulty, the more hashpower is needed to find a block.

When the mining difficulty on the network is lower, it is far easier for bitcoin miners to find blocks. A difficulty that keeps rising alongside the hashrate means an attacker will have to spend enormous amounts of resources to breach the system.

Bitcoin’s upcoming difficulty change comes at a time when Chinese miners have been told to operate elsewhere and a great portion of hashpower went offline this past Monday. During the last BTC difficulty change at block height 687,456 on June 13, 2021, the global hashrate was around 142.68 exahash per second (EH/s).

Since block height 687,456, BTC’s hashrate dropped by 39% to 86.5 EH/s. Bitcoin’s network difficulty has dropped two times prior to the upcoming 27% slide expected on Saturday.

November 2020 and October 2011 Precede Bitcoin’s Largest Difficulty Slide in History

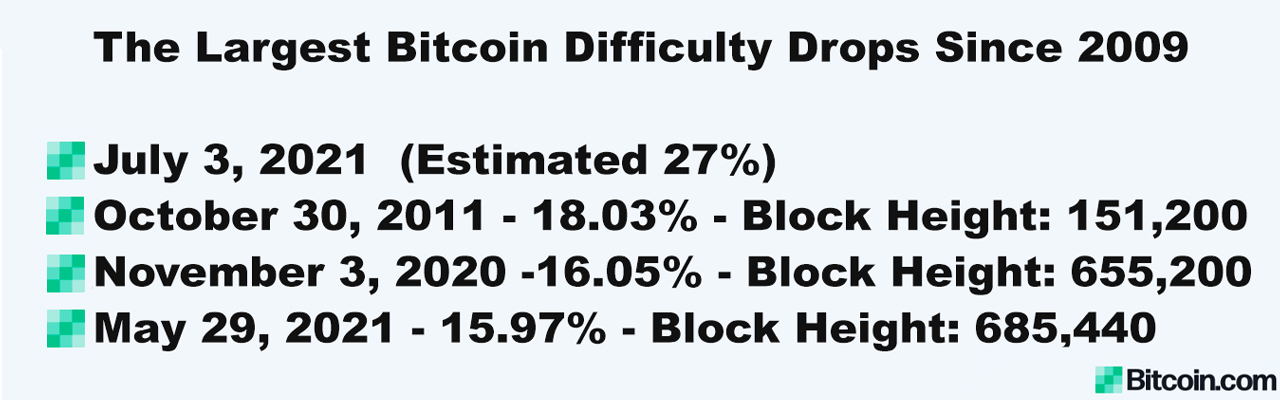

The largest difficulty drop so far in BTC’s lifetime, took place on October 30, 2011, the day before Halloween.

At that time, the difficulty slid 18.03 %, at BTC block height 151,200 when the global hashrate was a meager 8.61 terahash per second (TH/s). For some perspective, today a single next-generation bitcoin miner crafted by Microbt or Bitmain commands hashpower of around 100 TH/s.

Interestingly, BTC did not see a large drop like the one in 2011 until block height 655,200 recorded on November 3, 2020. At that time last year, the mining difficulty slid 16.05% and the hashrate was around 120.12 EH/s.

Usually, BTC’s difficulty goes up more so than the number of times it has slid down during the course of its lifetime. At Bitcoin block height 685,440, BTC’s mining difficulty slid 15.97% on May 29 when the hashrate was roughly 150 EH/s.

Block Times Expected to Smooth, Hashrate Expected to Increase

At today’s 86.5 EH/s hashrate and the current 19.93 trillion difficulty, block times have been longer than ten minutes on average. After the Bitcoin difficulty change on Saturday, the time between blocks should smooth back over to closer to ten minutes on average.

Since June 29, BTC’s hashrate has increased a great deal as 30-day hashrate statistics show the network’s hashpower was only 66 EH/s that day. Saturday’s difficulty change will not only be a milestone but will also make it much easier for miners to continue ramping up resources.

What do you think about the mining difficulty change set to happen on Saturday? Let us know what you think about this subject in the comments section below

This announcement has made people think that the U.S. is cracking down on El Salvador for choosing to leverage bitcoin. “Unconventional Warfare (UW) in action,” explained the popular anonymous analyst Plan B on Twitter. “See link below for what happens to countries that refuse IMF demands [and choose] freedom,” Plan B

This announcement has made people think that the U.S. is cracking down on El Salvador for choosing to leverage bitcoin. “Unconventional Warfare (UW) in action,” explained the popular anonymous analyst Plan B on Twitter. “See link below for what happens to countries that refuse IMF demands [and choose] freedom,” Plan B