2021 continues to bear witness to the continual rise in non-fungible token (NFT) prevalence and innovation. Following on from 2020 – where the NFT market was claimed to have tripled in total transaction value – NFT sales in just the first quarter of 2021 reached over a whopping $2 billion.

As the NFT market foundations progressively become cemented in place, it becomes apparent that the high of money-making can only go so far – there is a growing necessity to focus on the sentimental side of NFT ownership, with the space steadily hungering for growth and is now developing the need for something next level.

Musée: Digital Real Estate for Creators and Collectors

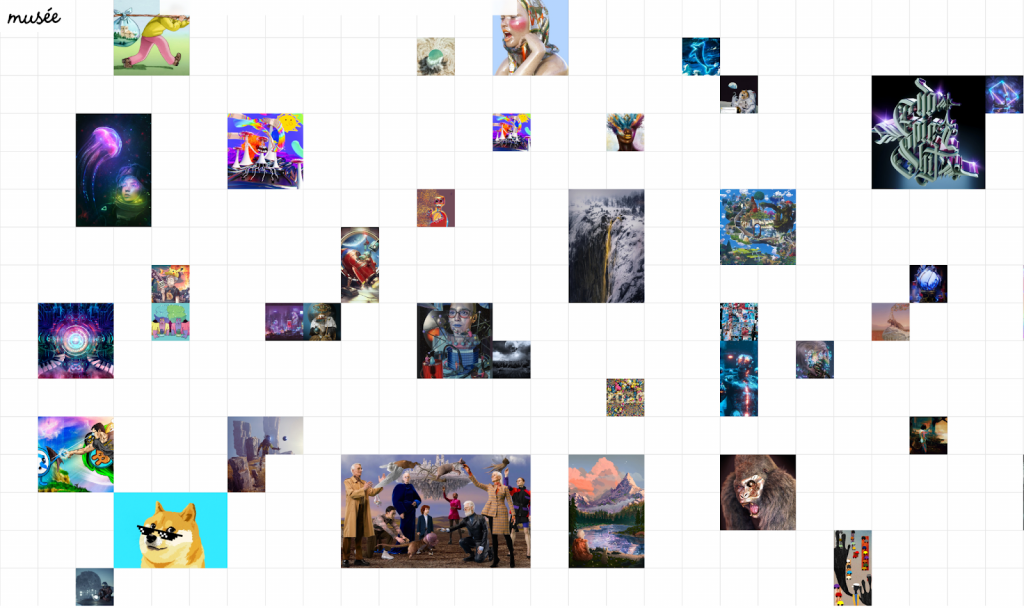

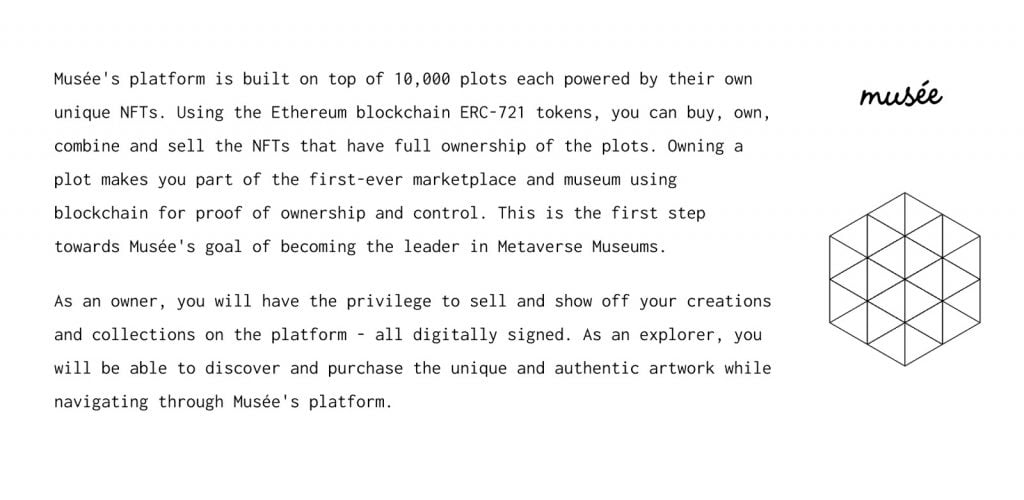

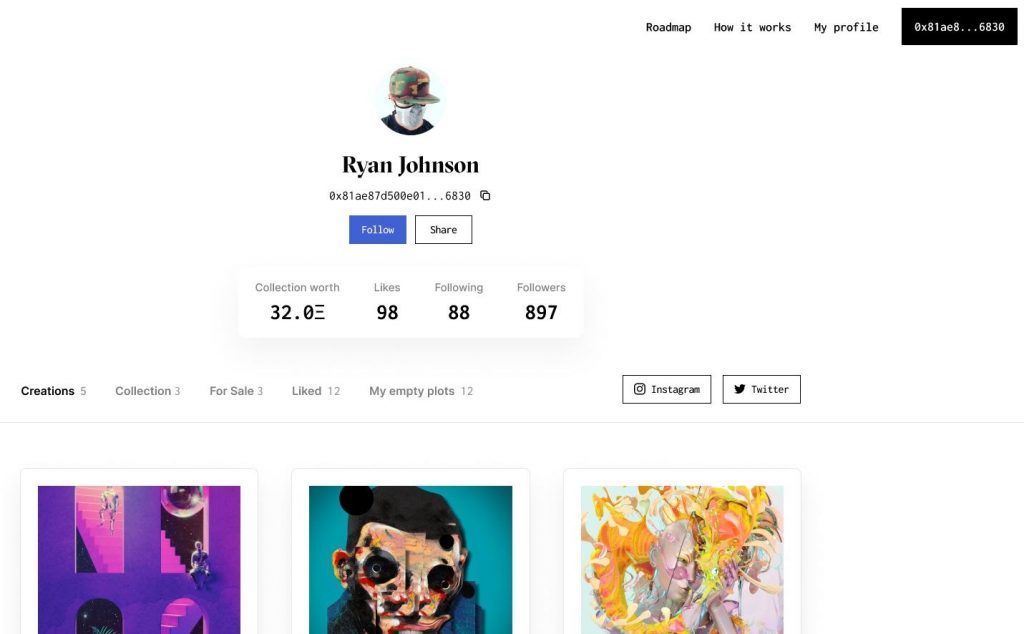

Musée is an NFT-owned marketplace platform built upon a finite number of digital plots, where owning a plot allows users to sell and share their creations or NFTs from their collections directly on the grid. All plots are visible from the homepage as soon as users land on the platform and anyone can purchase as many plots as they like, and even interact with other users’ content.

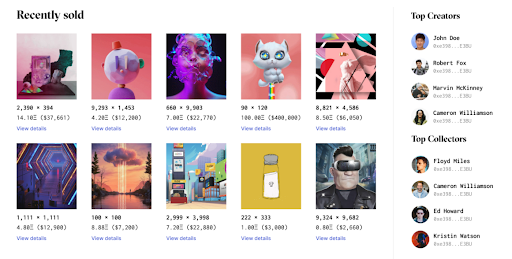

When landing on the homepage, the first thing users see are any available empty digital plots, and the NFTs already occupying purchased plots. This ensures the allocated plots are the first and foremost visuals visitors see; ensuring maximum exposure for all forms of NFT artwork on all digital plots. Visitors will have the ability to enjoy a full screen exploration mode as they discoverer the available NFTs for sale from the plot owners.

Using the Ethereum blockchain ERC-721 tokens, interested individuals/parties can purchase, own, combine, and sell NFTs that have full ownership of the plots. Pioneering the digital art-NFT space, Musée develops the first ever marketplace/museum fusion via blockchain to secure Proof-of-Ownership (PoO), and control of the space. Musée believes that the artworks and collectibles of the modern digital era can be anything from a digital Mona Lisa, to a simple Tweet.

Musée provides all users with a place to congregate and come together to express, find joy, sell their art, and become part of a like-minded, positive community. As users purchase plots and portray their NFT imagery to the world, they steadily fuel the future of the blockchain art revolution. As part of Musée’s evolution, it will become a complete social platform where plot owners can engage with their followers.By broadcasting art openly and ensuring it remains the focal point of the platform, Musée’s homepage reinforces the importance of art and expression. Enabling people from all walks of life to celebrate art socially and display their most coveted NFTs openly, the innovation Musée presents will change the way in which people interact with art forever.

Musée’s future plans are to be the leading museum of the virtual worlds, the metaverse – the Louvre Museum of the digital era. The owners of the first 10,000 plots have the chance to own a part of history.

Musée Features

As aforementioned, the moment users land on the homepage, the digital plots are the first thing they see. Each recently sold and listed digital plot comes with their plot size dimensions, the price in ETH (and USD), and a “View details” link to direct interested parties to the plot. Just like physical real estate, plot owners will have the opportunity to increase the value of their land in many ways. As users gain followers, so does their plot(s), increasing its resale value. In the future, plot owners will be able to invite guest artists to participate within their plots for limited drops.

The platform’s main focus is the grid containing all the plots. It is the milliondollarhomepage of the NFT era. But unlike the milliondollarhomepage, Musée will remain a living and evolving page due to the power of NFTs.

Functioning as a social platform and cornerstone for NFT art, Musée truly revitalizes the world of art, museums, and NFTs. Reinventing the way people cherish and view NFT art, Musée bolsters NFT value, creates a space for culture, and identity; all while providing an entity that truly belongs to the community. In a world where physical institutions are becoming increasingly scarce and difficult to visit, Musée breathes life into a platform that facilitates expression, and connection; globally.

Musée Plot Sale and Launch – 20th July, 2021

But all this would not be possible without first making the plots available for purchase – and it is with excitement that Musée are gearing up for their launch day. Pegged for July 20th at 9AM EST, Musée will make all plots available for sale at 0.5ETH per plot, giving users a way to cherish their digital art and collectibles forever.

Having explored its many features and pioneering direction, Musée’s game-changing potential is clear. Musée offers a social platform that not only connects people but also allows them to build upon a museum-like digital plot that could display their art forever. Add in the option to sell that NFT and/or plot and it is easy to find an option for prosperity and expression not openly available anywhere else.

That which has been limited to physicality and centric ownership for an era is now transitioning to the boundless planes of the internet. A place where creators and contributors alike have the opportunity to seize ownership of what they love.